When it comes to arranging for the future, lifestyle coverage methods are sometimes the very first thing people consider. They provide a way of safety and peace of mind, understanding that your family members will be economically shielded in the event that the unanticipated comes about. But daily life insurance plan can be quite a difficult concept to grasp, especially when you are bombarded with so a number of policies and conditions. So, how do you know which lifetime insurance policy solution is right for you?

Let’s break it down. Existence insurance coverage is available in numerous sorts, Just about every created to meet up with different demands and financial plans. Whether or not you’re on the lookout for a thing easy and affordable, or a far more extensive plan that builds cash value with time, there’s a existence insurance policy Answer customized just for you. But before we dive in to the details, it’s significant to comprehend the goal of lifestyle insurance. It’s not simply a fiscal safety net; it’s a method in order that All your family members can proceed to thrive, even when you are no longer around.

An Unbiased View of Full Coverage Insurance Solutions

The first step in Discovering everyday living insurance coverage methods is to be aware of the differing types of protection offered. The 2 principal classes are expression daily life insurance plan and long-lasting daily life coverage. Expression existence insurance plan provides protection for a selected timeframe, ordinarily ten, 20, or thirty decades. It’s typically a lot more reasonably priced than lasting daily life insurance policies, making it a preferred option for younger family members or people over a spending budget. On the other hand, as soon as the term expires, the coverage ends, meaning it’s not an option If you need lifelong protection.

The first step in Discovering everyday living insurance coverage methods is to be aware of the differing types of protection offered. The 2 principal classes are expression daily life insurance plan and long-lasting daily life coverage. Expression existence insurance plan provides protection for a selected timeframe, ordinarily ten, 20, or thirty decades. It’s typically a lot more reasonably priced than lasting daily life insurance policies, making it a preferred option for younger family members or people over a spending budget. On the other hand, as soon as the term expires, the coverage ends, meaning it’s not an option If you need lifelong protection.Conversely, long term life insurance policies remedies past your total life span, as long as rates are paid. In just lasting lifetime insurance coverage, there are various variants, such as total life, common lifetime, and variable lifetime insurance policies. Each and every of these has its exclusive capabilities, for example cash benefit accumulation, flexible premiums, and financial investment options. Whole life insurance plan, for example, provides a mounted quality along with a certain death reward, offering both of those safety plus a personal savings part that grows over time.

Now, let us discuss the value of acquiring the proper life insurance policy Option for your own situation. When choosing a coverage, it’s crucial to contemplate your monetary objectives, family members framework, and future demands. Do you want your beneficiaries to receive a big payout, or would you prefer a plan that can serve as a financial asset Down the road? The answer to those questions may help guidebook you toward the ideal coverage. It’s also vital to assess your funds—some policies tend to be more cost-effective than Other folks, and also you’ll would like to ensure the premium matches comfortably within just your economical strategy.

The most useful elements of everyday living insurance plan options is their capacity to deliver economic safety to your family members. If something were to occur to you personally, your plan would pay out a Dying profit that will help cover funeral prices, fantastic debts, and dwelling charges. But lifetime insurance coverage can also serve other functions past preserving your family’s economical upcoming. For example, some life insurance plan remedies offer dwelling Gains, which allow you to obtain your plan’s hard cash price when you're still alive in the event of a terminal ailment or other emergencies.

A different aspect to contemplate when choosing a lifetime coverage Alternative is your age and wellness. The more youthful and healthier you might be when you purchase a plan, the reduce your rates are prone to be. When you wait around until you happen to be older or dealing with health issues, your rates might be appreciably larger, or you might be denied coverage entirely. This can be why it’s crucial to plan ahead and explore your options As you're in good overall health.

Everyday living insurance policies might also Perform a vital purpose in estate preparing. When you have belongings that you'd like to move on on your beneficiaries, a daily life coverage plan might help provide the required liquidity to deal with estate taxes, guaranteeing that your family and friends aren’t burdened with a substantial tax Invoice after you move away. By strategically incorporating daily life insurance policy into your estate system, you are able to develop a much more efficient and cost-productive method to transfer prosperity.

Permit’s also take a look at the pliability of existence coverage answers. In currently’s entire world, our desires are consistently transforming. That’s why some long lasting lifetime insurance policy insurance policies, like universal daily life, present adaptability with regards to premiums and death Rewards. With universal lifestyle insurance policy, you are able to modify your protection as your instances evolve, which makes it a superb selection for people whose money circumstance may perhaps fluctuate after some time. This flexibility is very beneficial for individuals who want to ensure their coverage continues to be in step with their wants.

Are you presently somebody that likes to acquire an Lively position in handling your investments? If that's the case, variable existence insurance policy could possibly be the right option for you. With variable life insurance coverage, it is possible to allocate a percentage of your premiums into various expenditure selections, for instance shares, bonds, or mutual resources. This can offer the probable for better hard cash Read full article worth accumulation, but In addition it includes much more threat. So, in the event you’re snug with the concept of industry fluctuations and want to be extra involved with your coverage’s growth, variable everyday living insurance policies might be a fantastic in shape.

Certainly, no daily life coverage Alternative is without its negatives. Expression lifetime coverage, even though inexpensive, doesn’t offer you any income worth or expense probable. As soon as the expression ends, you might have to buy a brand new policy, normally at a greater rate. Long-lasting lifetime insurance policies methods, However, might be costlier and will not be essential for everyone. It’s imperative that you weigh the benefits and drawbacks of every option before making a call.

When purchasing for existence insurance policy, it’s also crucial that you take into account the standing and monetary stability in the insurance provider. You want to be sure that the company you select is fiscally potent and it has a background of shelling out claims promptly. In the end, The complete stage of everyday living insurance coverage is to provide peace of mind, this means you’ll want to settle on a provider you'll be able to have confidence in to deliver on their promises.

The Greatest Guide To Full Coverage Insurance Solutions

Although daily life insurance plan is An important Section of Many of us’s financial preparing, it’s not the one Resolution. You will discover other strategies to shield All your family members and Create wealth, like buying retirement accounts, cost savings options, and other types of coverage. Lifestyle insurance coverage need to be found as one piece of a broader economical technique that assists you achieve your prolonged-time period plans and shield your family and friends.But Allow’s not ignore the psychological great things about lifetime insurance policy. Figuring out that your family will probably be taken care of monetarily can carry assurance, particularly when you’re the main breadwinner. Daily life insurance plan supplies a security net, ensuring that the family View detailsView more members don’t have to wrestle financially immediately after your passing. It’s a gift that keeps on supplying, extensive Once you’re absent.

Not known Details About Insurance Plans For Seniors

It’s also truly worth noting that existence insurance policy solutions can be quite a useful Software for entrepreneurs. In the event you own a business and wish to guarantee its continuity immediately after your death, everyday living insurance policies can provide the required money to acquire out your share on the small business or to deal with any financial obligations. In some cases, life insurance plan can even be made use of to be a funding resource for your buy-promote settlement, supporting to guard your small business partners and safe the future of your company.

Should you’re Uncertain about where to begin With regards to deciding on a daily life insurance plan Remedy, consider working with a monetary advisor or insurance agent. They will let you navigate different alternatives out there and ensure you’re making an informed determination based on your unique predicament. A professional might also allow you to recognize the fantastic print of each coverage, so you’re obvious on what’s integrated and what’s not.

In conclusion, daily life insurance coverage remedies are A vital element of a sound monetary strategy. Irrespective of whether you decide on phrase existence or long term lifestyle coverage, the target is similar: to safeguard your loved ones and supply economic safety once they want it most. By understanding your options and selecting the proper coverage for your requirements, you are able to ensure that All your family members is very well taken care of, no matter what the future holds. So, make time to explore your choices and discover a daily life insurance solution that works in your case. Your family and friends will thanks for it.

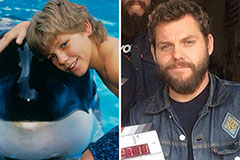

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!